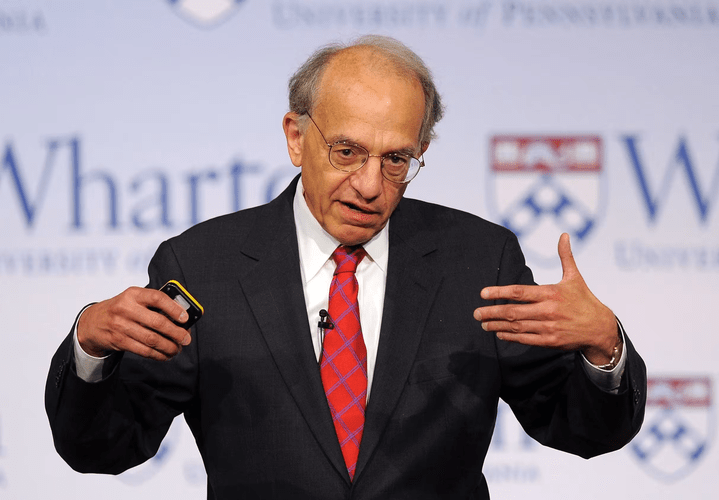

n a recent CNBC interview, world-renowned economist and expert on the financial markets, Wharton’s Jeremy Siegel didn’t mince words:

“It’s scandalous that we don’t have a rare earth strategic reserve [and] that we let China monopolize 90% of refining rare earth materials.”

Siegel’s comments highlight a reality M2i was founded to address. While policymakers debate how to secure America’s critical mineral future, M2i is already executing on it by working to develop the physical infrastructure, strategic partnerships, and verification tools necessary to deliver sovereign, traceable supply chains.

1. A Strategic Reserve: Not Just a Concept, but an Active Buildout

As highlighted in the first The Minerals & Metals Initiative podcast, hosted by M2i President and CEO Alberto Rosende and in conversation with Peter O’Rourke Sr., is leading the creation of a U.S. Critical Mineral Reserve (CMR).

Nearly 90% of the world’s rare earth materials are refined in China. This midstream monopoly presents a threat to U.S. defense, infrastructure, and economy as a whole.M2i Global’s response is clear: Build midstream at home. Not just mining, but processing, QA, traceability, and logistics. Through partnerships with the minerals and metals research institution Nova Terra and our own blockchain-secured traceability system, M2i is restoring American control over materials already moving through U.S. markets.

3. While Others Debate, We Are Getting to Work

“Where were we, realizing the importance of these [Critical Minerals]?” said Jeremy Siegel on CNBC’s “Squawk Box” earlier this week.

While others call for policy reform or multilateral frameworks, M2i is building the actual multi-sector execution platform. The company’s plans are aligned for DV compliance, IRA eligibility, and DPA scalability. M2i has active proposals in front of counterparts at DOE, and has active partnerships across defense, aerospace, and advanced materials sectors.M2i’s model reflects the urgency Siegel points to and provides a blueprint for moving beyond dependence toward sovereignty, speed, and strategic readiness.

Read the full CNBC article:

Wharton’s Jeremy Siegel says it’s ‘scandalous’ the U.S. doesn’t have a rare earths reserve